direct deposit owner's draw quickbooks

If an owner puts up 15000 of his own money to start up a business and then draws 10000 he reduces his equity in the company to 5000. Apply for Intuit Merchant Services in QuickBooks.

Select Equity and Continue.

. You need to refer to these following steps. To open an owners draw account follow the following steps. ACH is a useful payment method.

Visit the Lists option from the main menu followed by Chart of Accounts. Before you can record an owners draw youll first need to set one up in your Quickbooks account. Ad Answer Simple Questions To Make Your Direct Deposit Form.

Heres how you create an Owners Equity account. Create an Owners Equity account. The ACH fee per transaction is 3 for QuickBooks Desktop.

In the Chart of Accounts window select New. If any current. First of all login to the QuickBooks account and go to Owners draw account.

From the Account Type dropdown choose Equity. Easily Make ACH In Any NACHA Format For QuickBooks. However if his company shows a 20000 profit for the year QuickBooks shows that profit at the start of the next tax year as retained.

Ad Free Trial Version. Steps Order to Write a Check from an Owners Draw Account. At the bottom of the Chart of Accounts page you should see an option titled Accounts click it and choose New.

Setting Up an Owners Draw. Go to Settings and select Chart of accounts. Before you can pay an owners draw you need to create an Owners Equity account first.

When making a direct deposit payment to an owner youll need to set up an owner or partner as a vendor as suggested by my colleagues above. In order to write a check from an owners draw account. Click on the Banking and you need to select Write Cheques.

Create Legal Documents Using Our Clear Step-By-Step Process. The IMS fee per ACH is 1 of the transaction amount up to 10 for QuickBooks Online. If you already have employees information in QuickBooks Online you can simply select each employee and click Set Up to enroll them in direct deposit.

If you have been wondering about paying your 1099 Contractors with Direct Deposit now you can if you are a QBO Payroll or QBO Full-service Payroll user. Go to the Employees tab. QuickBooks charges a transaction processing fee when you accept ACH payments from customers through QuickBooks Payments.

For a partnership an equity account is set up for each partner.

Owner S Draw Via Direct Deposit Quickbooks Online Tutorial The Home Bookkeeper Youtube

Free Direct Deposit Authorization Forms 22 Pdf Word Eforms

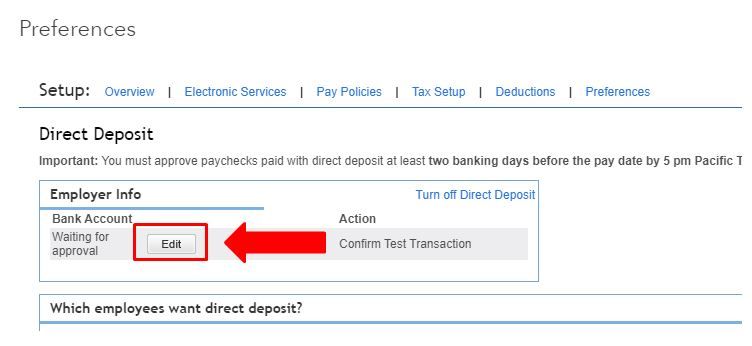

Changing Direct Deposit Account

How Do I Pay Myself Owner Draw Using Direct Deposit

Changing Direct Deposit Account

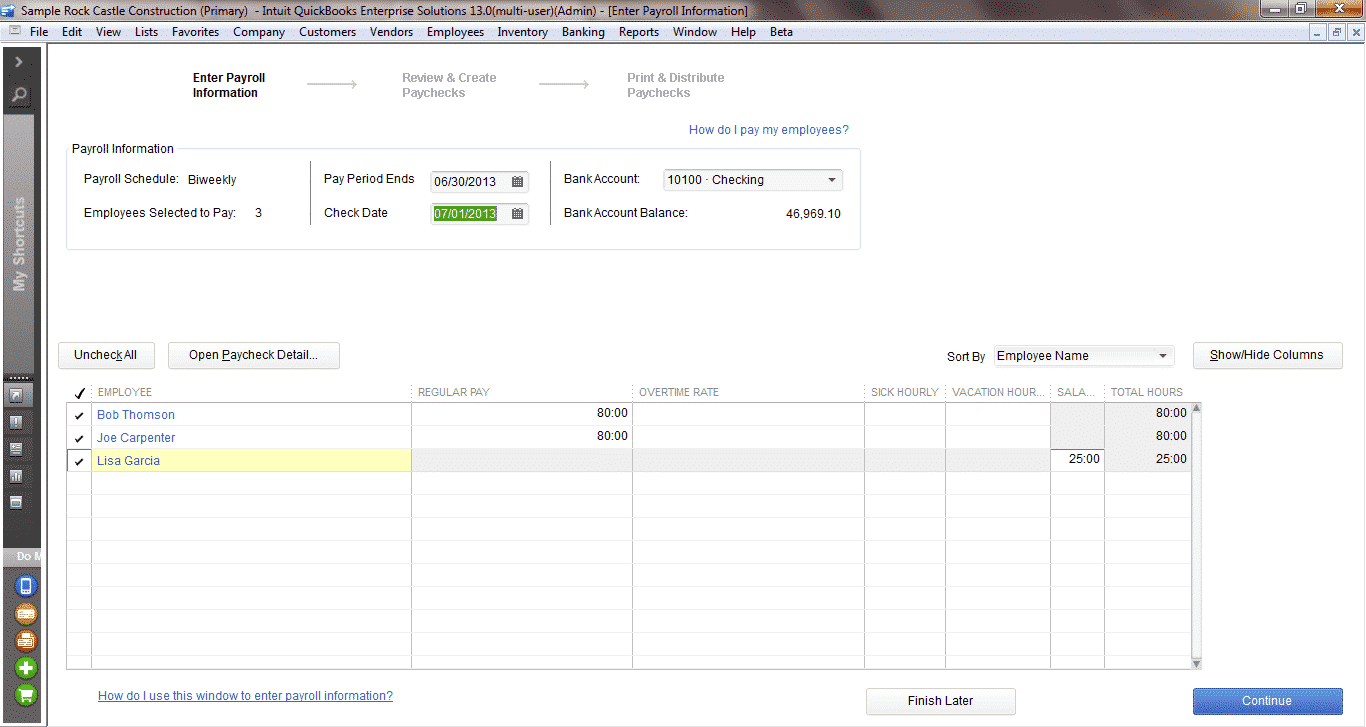

How To Set Up Pay Payroll Tax Payments In Quickbooks

Tutorial Pay A Contractor With Direct Deposit Quickbooks Online Youtube

Dimas Plovdiv 51 Bulgaria S Comments From Sdit Quot Nurul Islam Quot Krembung Sidoarjo Showing 1 20 Of 20

Generic Direct Deposit Form Template

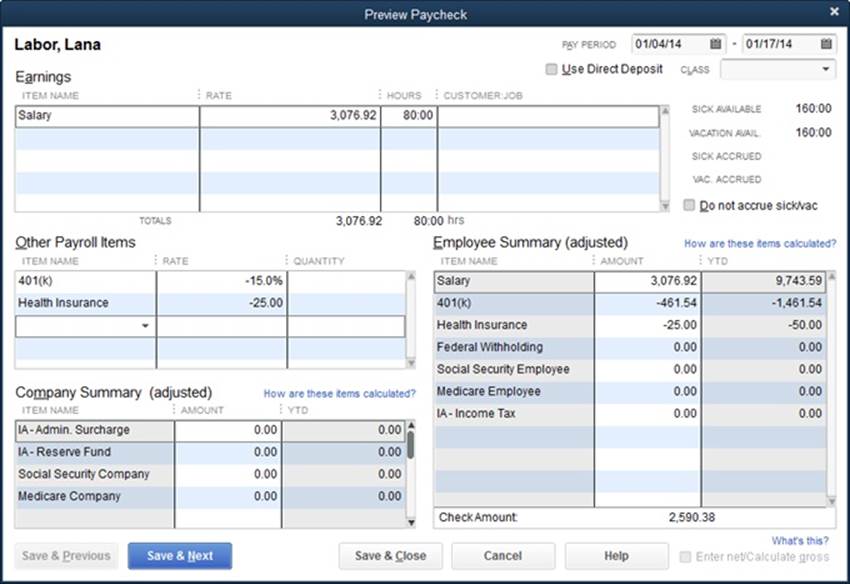

Doing Payroll Bookkeeping Quickbooks 2014 The Missing Manual 2014

How To Run Payroll And Set Up Direct Deposit In Quickbooks Online Payroll Youtube

How Do I Pay Myself Owner Draw Using Direct Deposit

Solved I Am Trying To Change My Direct Deposit Account Temporarily To Draw From An Account Specifically Setup For Ppp Funds Whats The Best Way To Do This

Intuit Quickbooks Desktop Enterprise 2022 Canadian Version Saas Direct Canadadata Migration1 Quickbooks 2021 Sale Quickbooks Desktop Enterprise 2022 Is Software Designed To Help You Manage Your Accounting And Business Needs Efficiently

15 Leading Cloud Payroll Software For 2022 Financesonline Com

How To Run Payroll And Set Up Direct Deposit In Quickbooks Online Payroll Youtube

10 Best Payroll Software For Small Businesses 2022 People Managing People

/INV-how-to-void-a-check-4797998-eb85b5eaea2748e6b023e9da567ed21e.jpg)